Disruptive Tech. Up to 50x Capital Efficiency. Millions of Users Attracted.

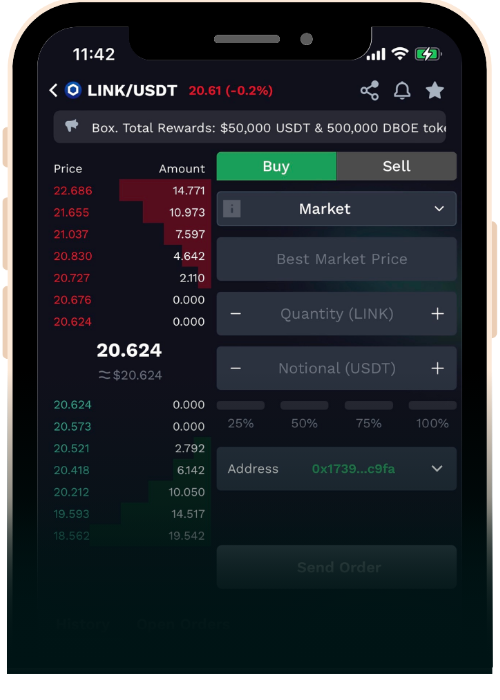

DBOE operates on our innovative On-Chain Order Book, seamlessly merging TradFi & DeFi to deliver unparalleled transparency & efficiency.

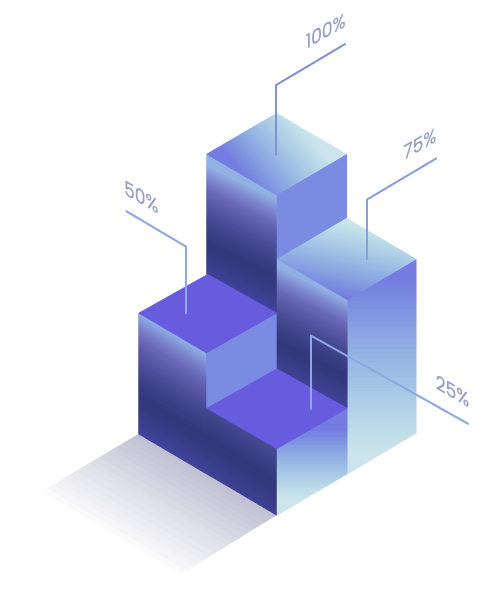

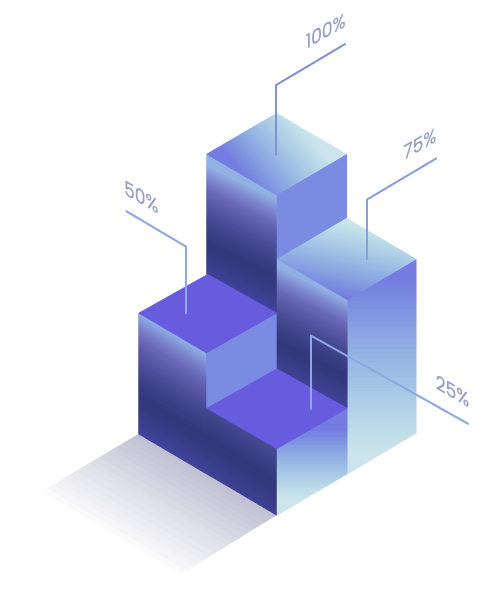

DBOE develops a unique Dedicated Market Maker (DeMM) technology, enhancing capital efficiency for market makers by 30-50 times compared to any other DEXs.

Portfolio margin is one component of DBOE ecosystem that is in the development phase as of now.

Enhance your options trading skills in a cost-free and risk-free practice environment designed.

DBOE integrated full On-chain, operating entirely on the blockchain for transparency and fairness.

DBOE develops a unique Dedicated Market Maker (DeMM) technology, enhancing capital efficiency for market makers by 30-50 times compared to any other DEXs.

Portfolio margin is one component of DBOE ecosystem that is in the development phase as of now.

Enhance your options trading skills in a cost-free and risk-free practice environment designed.

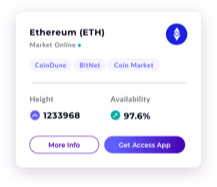

This ecosystem serves as a ready-made platform for the On-chain RWAs Secondary Market, utilizing our unique On-Chain Order Book and DeMM technology.

Our Spot Market leverages the innovative On-Chain OB to prevent slippage and unique DeMM technology to optimize capital and reduce money laundering risks. RWA projects can collaborate and share revenue up to 80%.

Staking utilizes DeMM to offer users attractive returns, with up to 40% APY for On-chain RWAs, significantly outperforming the market.

By partnering with DBOE to fully unlock the demand and growth potential of asset tokenization, RWA issuers can reduce capital expenses by up to 50x and claim up to 80% of the revenue sharing. Don’t miss out – this exclusive offer is available only to our first partners.

Traded Value Record

Followers on Galxe

Community Users

Airdrop Participants

Our Business and Ecosystem Partners