According to a New York Stock Exchange (NYSE) report, the volume of options trading has increased since the pandemic in 2020 as stock investors are looking to diversify their portfolios. The same goes for crypto, but skepticism about this asset remains related to its high volatility. The big question for many inventors is how to capture this opportunity cautiously. Thus, DBOE presents the answer to that question through our crypto options trading platform. Here are three reasons why investors should try crypto options on DBOE.

1. Zero Counterparty Risk

Merkle Science states, “counterparty risk refers to the potential loss arising from the failure of a contractual obligation by one party to another.”

For example, one typical example of counterparty risk in crypto options occurs when trading on a centralized exchange. In this scenario, traders deposit their funds with the exchange, which acts as an intermediary for all transactions. If the exchange faces financial difficulties, gets hacked, or experiences other issues, traders may lose access to their funds or face withdrawal delays.

DBOE provides investors a significant advantage by operating on a decentralized platform that eliminates counterparty risk. Unlike traditional options trading venues, we employ a non-custodial approach, where users retain control of their assets throughout the trading process. This design ensures no intermediaries are involved, avoiding issues related to trust and defaults that can pose considerable risks in centralized exchanges.

The zero counterparty risk allows investors to engage with confidence, knowing that their transactions are secured and protected from the potential failures of other market participants. This feature particularly appeals to stock options investors seeking a safer environment to explore crypto options, providing them with a layer of security typically absent in traditional financial markets.

2. Allowing Implementation of Diverse Options Strategies

DBOE offers a variety of opportunities that cater to the needs of diverse traders, making us an attractive venue for stock options investors looking to expand their portfolios. We provide four distinct positions for options trading: long calls, long puts, short calls, and short puts. This diversity allows traders the flexibility to hedge against market volatility, speculate on future price movements, and implement intricate trading strategies tailored to their market outlook.

By employing different options, investors can limit potential losses while still positioning themselves for potential gains. This flexibility and strategic variety allow users to adapt to varying market conditions, enhancing the overall trading experience.

Moreover, DBOE’s innovative features, such as the ability to trade options on a peer-to-peer basis, make it easy for stock options investors to integrate crypto options into their existing trading strategies. The seamless transition between traditional and crypto options markets can lead to better portfolio diversification and risk management practices, essential in today’s volatile market environments.

Furthermore, DBOE options are unique in operating on innovative Price Ranges, a model exclusive to DBOE. Because of this functionality, DBOE simplifies trading and better limits traders’ loss.

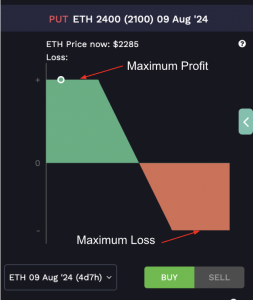

Let’s illustrate with an example: Assume the current price of ETH is $2285. The trader ordered a Buy Call ETH option within the 2100-2400 price range, at a bid price (premium) of $30. At expiration, the buyer’s profit & loss would be calculated as follows:

- ETH price at expiration ≥ Target strike price: Maximum profit: ($2400-$2100)-$30= $270

- ETH price at expiration ≤ Target strike price: Maximum loss: -$30

- ETH price at expiration between the Price Range: PnL = (Price at expiration−Strike price)−Bid price

You can also quickly check your profit/loss estimation with the PnL chart on DBOE:

3. Cost-Effective Trading

One of the advantages of trading crypto options compared to stock options is their cost-effectiveness. The premiums associated with crypto options can be lower than those for traditional stock options, primarily due to the higher levels of volatility within the crypto space. This inherently allows investors to manage their exposure more efficiently without overly compromising their portfolios.

Investors can enter the crypto options market with relatively lower capital outlays. For example, by only paying the option premiums, traders can control a larger amount of the underlying asset than they would with direct investments. This is particularly important for stock options investors looking to expand their reach without significant additional capital outlay.

Furthermore, the operational framework of platforms like DBOE enhances capital efficiency for option sellers. Maximizing potential returns while offering a non-custodial, decentralized trading environment allows traders to engage without the burden of third-party fees associated with centralized exchanges. This aspect appeals to stock options investors, who are often accustomed to higher trading costs associated with traditional brokerage firms.

Lastly, the ease of access to crypto options trading via platforms like DBOE also contributes to cost savings. Investors can execute trades swiftly, without extensive delays often associated with traditional stock markets, thus capitalizing on favorable market conditions without incurring unnecessary costs. Read through the steps to start using DBOE here!

Conclusion:

Ultimately, DBOE is an excellent tool for stock options investors to gain exposure to the new and exciting realm of cryptocurrency. With enhanced risk management and cost-effective trading, investors can safely invest and implement complicated trading strategies.

——————————————————————————–

At DBOE, we provide comprehensive resources and support to help you navigate the complexities of options trading. We aim to make options trading more secure and accessible.

Start your options trading journey with DBOE today at: Website or Mobile app.

Disclaimer: The information in this article is not intended as investment advice. Cryptocurrency investment activities are not legally recognized or protected in some countries. Cryptocurrencies always involve financial risks.