In order to become a professional investor in any financial field, short call options is a should-have skill, especially in the crypto world where the market is more volatile than any other markets so the need of knowing a safe derivative tool with limited risk is crucial.

What is a Short Call option?

A short call is an options trading strategy that involves a trader selling (or “writing”) a call option with the expectation that the price of the token will drop at the expiration time. The call option buyer, meanwhile, is betting that the price will rise.

Example: A trader short call options on SOL/USDT

Two outcomes:

- If the price of SOL drops, seller of the call will pocket the premium for the options contract. The premium is based on the market value of SOL and the options date.

- If the price of SOL increases, the seller (writer) of the short call will complete the transaction and collect the difference between the options price and the current market price of SOL.

As for now Short Call Options on any exchange of any field of finance can lead to unlimited risk due to the unlimited price pump probability. Noticing the consequences, DBOE decided to solve this problem with our innovative technology and created the Price Range feature.

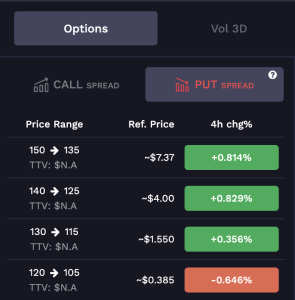

What is the Price Range?

As simple as it sounds, Price Range is the combination of a strike price and a target price on the expiration date representing options writer’s range of potential loss from minimum to maximum.

Example:

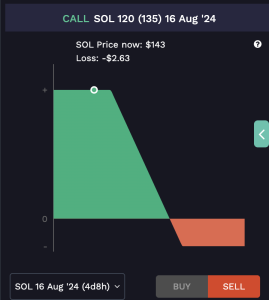

For example a price range of 135-150 for SOL Options means that the strike price is $135, the target price is $150 and the spread, which limits the max loss, is $15.

If you want to sell (or “write”) a call option normally with other exchanges, you can only see your expected profit but never expected loss due to the unlimited risk. But with DBOE, you can see your PnL (Profit and Loss) for every action because if the price at expiration exceeds the price range, buyers won’t profit from the option contract anymore so the maximum loss for a short call option is predictable.

Options writers can evaluate their minimum and maximum loss on an Option.

This feature is created to help options writers manage their risk more effectively and not to risk their entire balance every option they write.

Normal call options offered by most other exchanges, where there’s a strike price and if the current price of the underlying asset goes beyond the strike price, call options buyer can benefit unlimitedly considering how far the asset’s price goes beyond the strike price, also meaning that options writer must face an unlimited risk with limited profitability.

This is the main reason why the Options market tends to lack liquidity because of the low R:R (Risk:Return) that options writers have to face. Also because unlike DBOE, most exchanges to become an options writer often require high capital entry, even up to a 100,000 USDT just to write their first option.

How to Short Call Options for SOL on DBOE

- Step 1: Connect your wallet to DBOE:

Connect your wallet: Metamask, Core wallet, etc. with DBOE

- Step 2: Choose expiration date

Choose the expiration date in the SOL Options contract you want to sell

- Step 3: Choose price range and start your short call option

Choose a safe price range in the CALL column based on your personal analysis, enter the quantity after choosing and start trading.

- Step 4: Place an order an authorize for the first time

In order to increase security and optimize user experience to the fullest, you need to authorize trading from metamask:

You can choose to authorize automatically or remind each time you trade

Note: each new Options will need to be authorized again at least once

Why choose DBOE?

Out of every exchange, currently DBOE is one of the only 2 exchanges which provides SOL/USDT and LINK/USDT options. Besides, DBOE provides comprehensive resources and support in order to help you navigate the complexities and enhance risk management. At DBOE we aim to make options trading more secure and accessible.

Start your options trading journey with DBOE today at: https://dboe.exchange/

or https://download.dboe.exchange/ on mobile

Disclaimer: The information in this article is not intended as investment advice. Cryptocurrency investment activities are not legally recognized or protected in some countries. Cryptocurrencies always involve financial risks.