Since the beginning of August 2024, BTC has been down almost 30% from its peak, ETH has been down 34%, and SOL has been down 32% within a short period of time. The fear of a recession looms over the market, with 2.9 trillion dollars seemingly vanishing from the stock market. This has inevitably impacted the cryptocurrency market, causing considerable declines. The Fear & Greed Index, as depicted in the provided CNN rating, underscores a prevailing sentiment of fear, with the index sitting at a starkly low 27. This suggests investors are wary, potentially paving the way for defensive financial strategies.

However, this downturn is not necessarily a financial apocalypse. There are potential avenues for investors to profit even in bearish markets. The concept that stands in the spotlight here is buying put options. This defensive maneuver not only safeguards against infinite losses but also offers a solid path to make gains from falling prices. Let’s delve deeper into this tactic and explore the potential for significant gains.

Introducing Put Options: The Safety Net of Your Investments

First and foremost, what is a put option? Put Options allow investors the right but not the obligation to sell the underlying asset at a predetermined price, called the strike price, at a designated time. This key feature provides a safety net for investors looking to hedge against adverse price movements. More importantly, it opens a window for profits in a declining market.

Understanding the mechanics is crucial. A put option’s value rises when the underlying stock or security price falls. Conversely, the put option’s value diminishes when the stock price ascends. Due to this inverse relationship, investors often harness put options as a hedging strategy or a means to capitalize on anticipated downward price movements in the market. This inverse correlation makes buying put options a powerful tool for investors aiming to hedge their portfolios or exploit bearish trends.

Scenarios:

Given the current market’s volatility and bleak sentiment captured by the Fear & Greed Index, put options present a valuable opportunity. The market seems poised to continue its downward trajectory, and buying put options not only allows investors to gain from this decline but also provides a significant level of protection against infinite loss, unlike futures contracts where loss potential is theoretically unlimited. This added security can provide a sense of reassurance in these uncertain times.

Let’s contemplate some scenarios:

1. Scenario 1: Gain

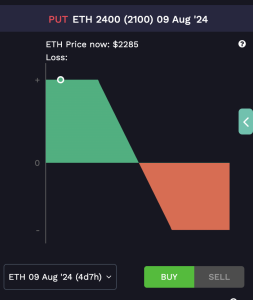

Suppose an investor buys a put option of ETH/USDT with a spread of $300, expecting the price to move from $2400 to $2100 with a premium of $50, and the contract expires in a week. This is how DBOE calculates the maximum gain for the investor:

- PnL = Amount * (Spread – Premium)

So if the price at the end of the week is $2050, the maximum gain would be:

- 1 * (300-50) = $250, which is five times the initial investment of $50 you paid to buy put options.

The gain is the same if the price moves under the price range.

But what if the price is within the price range? Here is DBOE’s formula for that:

- PnL = Amount * [(Price at expiration – Strike price) – Premium]

2. Scenario 2: Loss

Keeping the same situation, what if the price at the end of the week rises to $2500? It would not make sense for the investor to execute the contract because they would lose money. As a result, the maximum loss would be the premium an investor would pay to buy the put option, which is $50.

The Profit and Loss (P&L) can be captured by the graph on the website:

DBOE offers an in-house creative pricing range designed to simplify trading and minimize losses for users. Traders are encouraged to leverage the current bearish market conditions by utilizing DBOE’s innovative functionalities to maximize their gains. Visit the DBOE Exchange to take advantage of these opportunities.

Conclusion

In conclusion, while the market sentiment captured by the Fear & Greed Index indicates significant trepidation, informed investors can find opportunities amidst the uncertainty. By leveraging the strategic advantages of put options, investors can hedge their portfolios against adverse price movements and capitalize on a declining market. Using put options effectively provides a feasible pathway to safeguard investments and achieve substantial returns, even in tumultuous financial landscapes. Thus, savvy investors who grasp the nuances of put options can confidently navigate the bearish trends, turning potential market declines into profitable ventures.

Disclaimer: The opinions expressed are personal viewpoints intended for informational purposes only. The author does not assume responsibility for any financial losses incurred in cryptocurrency trading. It is imperative to conduct thorough research and seek advice from financial experts before making any investment decisions.